Introduction

Inspired by BEPS Action Plan 1, Colombia decided to enact, effective as of 2024, a tax on income generated by nonresidents with a significant economic presence in Colombia, i. e. a tax on e-commerce.

The reasoning in the bill submitted by the Government to Congress, introducing the new tax, explains:

“Capital-importing countries such as Colombia have suffered a significant loss in their rights to tax activities carried on by foreigners in connection with its territory. This loss is due to the fact that international rules allow foreign companies to be taxed only in the presence of the so-called permanent establishment (PE), i.e., when the company has a fixed physical presence and a duration of activities of at least one (1) year in the country. In the midst of the digitalization of the economy, the physical presence and the 1 year duration are not necessary to carry out very relevant activities from an economic point of view, with an expectation for a greater reduction in the physical scope of business and in the times to carry out the different activities.

“Emerging countries, such as Colombia, are the most affected by this situation. However, the solution currently offered by the international community (the so-called Pillar 1) only covers about 108 companies (with annual turnover of over 20 billion euros), and only transfers the right to tax profits in a minimum percentage that represents less than 0.5% of the current revenue, according to the calculations of the DIAN[1] and experts. In addition, experts currently assign a low probability to the ratification of the Multilateral Convention (MLC) that would implement the solution. Thus, if Colombia does not approve an alternative solution, it would lose the opportunity to tax the revenues of the digital economy.”

That is, rather than following the BEPS principles -including the fact that no taxes shall be imposed on e-commerce, Colombia decided to approve an alternative solution in order not to lose the opportunity to tax digital economy revenues.

As seen, the new tax is merely revenue-oriented, intended to tax electronic transactions that presently escape taxation in Colombia. Thus the fact the Article 20-3 of the Tax Code, introducing the new tax, is embodied in Title VI of Law 2277 of 2022, labeled “Combat Mechanisms Against Tax Evasion and Avoidance”.

For this very reason, this tax does not apply to transactions that are already subject to income tax under other provisions of the Tax Code, such as technical services, consulting services, technical assistance and education services, even if they are provided electronically.

Furthermore, the bill submitted by the government to Congress underwent major changes during the debates, both at the House and at the Senate, thus resulting in a hodgepodge, with inconsistencies.

Let us delve into the salient features of the new tax.

Taxable Income, Taxpayers

The first paragraph of Article 20-3 of the Tax Code provides that there is subject to Colombian income tax all income from the sale of goods or from service, received from clients and/or users located in Colombia, by individuals who are not residents of Colombia or legal entities with no domicile in Colombia, provided they have a significant economic presence in the country.

It appears, in principle, that, in addition to taxing sales of goods, this tax is addressed at taxing any type of services, as the provision mentioned above refers to services in general, drawing no distinction. Reference to services, in general, also appears in other sections of Article 20-3.

However, based on the reasoning in the bill submitted to Congress, quoted above, and on the debates there, in our opinion the tax applies exclusively to digital services through a significant economic presence in Colombia, not to all types of services.

Digital Services

The regulations define digital services as those services provided through the internet or an electronic network in an automated manner, that require minimal human participation by the service provider and are impossible to guarantee in the absence of information technology.

Digital services are listed in Article 20-3 of the Tax Code itself, in what in principle appears to be a comprehensive list of taxable services, as follows:[2]

- Online advertising services.

- Digital content services, whether online or downloadable, including mobile applications, e-books, music and movies.

- Free transmission services, including television shows, movies, streaming, music, multimedia transmissions, podcasts and any form of digital content.

- Any form of monetization of information and/or data of users located in Colombia, which have been generated by the activity of such users in digital markets.

- Online intermediation platform services.

- Digital subscriptions to audiovisual media including, but not limited to, news, magazines, newspapers, music, video and games of any kind.

- Management, administration or handling of electronic data including web storage, online data storage, file sharing services or cloud storage.

- Standardized or automated online search engines services or licensing, including custom software.

- Granting the right to use or exploit intangibles.

But, at this point, the last two items in the list are, in fact, catchall provisions that lead to the conclusion that all digital services through a significant economic presence in Colombia are subject to this tax:

- Other electronic or digital services destined to users located in Colombia.

- Any other service provided through a digital marketplace destined to users located in Colombia.

Significant Economic Presence

Again, working around the inconsistencies in the law, in our opinion a significant economic presence in Colombia exists, for both sales of goods and for digital services, whenever both of the following requirements are met:

- That a purposeful and sustained interaction is maintained in the Colombian market, that is, with customers and/or users located in Colombia.

- That during the previous or the current tax year the taxpayer generates gross income from such users of at least thirty-one thousand three hundred (31,300) UVT[3].

These requirements are aggregated when the activities are carried out by related parties, as defined in the Tax Code.

Purposeful and Sustained Interaction Presumption

The law includes a rebuttable presumption to the effect that a purposeful and sustained interaction in the Colombian market, that is, with customers and/or users located in Colombia, exists in any one of the following events:

- When the non-resident individual or the entity not domiciled in Colombia maintains an interaction or marketing deployment with three hundred thousand (300,000) or more customers and/or users located in Colombia during the previous or the current tax year.

- When the non-resident individual or the entity not domiciled in Colombia maintains or establishes the possibility of displaying prices in Colombian pesos or allowing payment in Colombian pesos.

As mentioned, the 300,000-customers-or-users threshold is only a rebuttable presumption. Therefore, it doesn’t mean that by reaching that threshold an individual or entity will necessarily be found to have a purposeful and sustained interaction In the Colombian market, as the presumption could be rebutted with whatever arguments may be available in any specific case. By the same token, having less than 300,000 customers and/or users does not necessarily mean that no purposeful and sustained interaction will be found to exist. The underlying issue is that neither the law nor the regulations include any guidance as to when a purposeful and sustained interaction should be taken to exist.

Users Located in Colombia

With respect to digital services, the regulations provide that users are deemed to be located in Colombia in any one of the following events:

- The domicile or where the client habitually resides or lives is located in Colombia.

- Payments are made through credit, debit or other types of cards or vouchers or through any payment mechanism, located in Colombia.

- The credit or debit card used to pay for the transaction was issued in Colombia.

- The shipping address for the sale of goods is located in Colombia.

- The Internet Protocol (“IP”) address of the device used by the client is located in Colombia, at the time of the operation.

- The country mobile code (MCC) of the international identity of the subscriber of the mobile service stored in the SIM card (subscriber identity module) used by the client locates the client in Colombia.

As regards sales of goods, the users are deemed to be located in Colombia whenever any two of the above conditions are satisfied.

Tax Rates, Payment

Significant economic presence taxpayers are subject to tax under one of three different scenarios.

- Under the general rule, the tax is paid through withholding, at a 10% rate on gross revenues without deductions. As mentioned in the introduction, in that this tax was designed to curb tax evasion and avoidance, this withholding does not apply where the payment in question is already subjected to tax withholding under other sections of the Tax Code. Where all income is subjected to withholding tax, the taxpayer need not file tax returns.

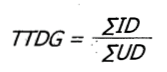

- As an option, an election may be made to file tax returns, pay a 3% tax on gross revenues from the sale of goods or from the digital services, and thus for no withholding tax to apply. Under this election, the taxpayers must register for tax purposes in Colombia, make bi-monthly 2% estimated tax payments and file annual returns.

- Alternatively, under the election in b. above the taxpayer may nonetheless elect for the 10% significant economic presence tax withholding to continue to apply as a means for payment of the tax, with the right to refunds of the excess of the taxes withheld over the 3% annual tax rate.

Tax Treaties

To rest the international community assured that Colombia does not intend to dishonor its international commitments, the law includes a provision, originating from the bill submitted to Congress, expressly providing that the new tax is without prejudice to the provisions of the double taxation conventions signed by Colombia.

In the same vein, Congress introduced a provision to the effect that whenever any international agreement signed by Colombia prohibiting taxation of electronic commerce is implemented, the domestic provisions dealing with this tax shall cease to apply for fiscal years beginning after the date on which the international agreement enters into force.

Constitutional Relief

A constitutional analysis of the tax is outside the scope of this general article.

We may, nevertheless, highlight the fact that foreign individuals and entities may find relief, dispensing them from payment and all other obligations related to this e-commerce tax, through an action filed before our Constitutional Court.

In the writer’s opinion there are at least two arguments that could render the tax unconstitutional:

- When dealing with the various elements of this tax, the law indistinctly makes reference to “services” or to “digital services”. This creates confusion, as it is not possible to conclude, with any degree of certainty, whether the tax applies to all services rendered by the intended individuals and entities or exclusively to digital services. This lack of clarity is contrary to our Constitutional principles and may be grounds for the court to rule the law as being unconstitutional.

- The law has no indication as to when an individual or entity is deemed to have a purposeful and sustained interaction with customers and/or users located in Colombia. This is, similarly, a cause for Constitutional relief against the tax given the uncertainty as to whether a given individual or entity may or may not be subject to the tax.

Conclusion

Enactment of the significant economic presence tax overcame objections from many of the large economic players in Colombia and within Congress itself. But not all is hunky-dory. Its practical implementation is complex, with issues such as the new taxpayer’s election to be taxed through withholding or by filing returns, reversal of such election, filing tax returns, payment mechanisms and proper withholding on all transactions to avoid the need to file tax returns, to mention a few.

BéndiksenLaw is here to assist you in navigating through this maze. Contact us.

Jaime G. Béndiksen

[1] The Colombian tax administration, National Taxes and Customs Directorship.

[2] This list of activities was borrowed by Congress from Kenya’s digital services tax and from Article 12B “Income from automated digital services” of the United Nations Model Double Taxation Convention between Developed and Developing Countries 2021.

[3] “Tax Value Units” or UVT for their Spanish acronym. The present UVT value is $47,065 Colombian pesos (roughly US$12).