Béndiksenlaw carries out a review of the use of cryptoassets in the context of companies in Colombia.

Read the news (in Spanish) here.

Contact us for more information, we will be happy to address your concerns.

Béndiksenlaw carries out a review of the use of cryptoassets in the context of companies in Colombia.

Read the news (in Spanish) here.

Contact us for more information, we will be happy to address your concerns.

Sebastián Béndiksen, managing partner of BéndiksenLaw Colombia, shares his perspectives with Actualícese about the incorporation of cryptoassets in companies and the role that managers must assume in relation to these resources.

Read the news (in Spanish) here.

Contact us for more information, we will be happy to address your concerns.

Our managing partner shares his experience and wisdom in the field of cryptoassets in an exclusive interview with Revista Semana.

Read the news (in Spanish) here.

Contact us for more information, we will be happy to address your concerns.

Source: click here

Did you know that the Labor Reform does not require of the State the same obligations that it imposes on private companies, such as the termination of contracts for the provision of services or the payment of overtime and night and Sunday surcharges?

According to the lawyer specialized in corporate law, Sebastián Béndiksen, the Labor Reform imposes obligations on the private sector that the government itself is not willing to comply with.

Other aspects to consider are the legal effects that this reform will bring to the relationship between employers and workers, including the Right to Strike in the provision of essential public services, the types of contracts that may be signed according to the needs of companies and the stability of formal employment.

Sebastián Béndiksen, is a lawyer and Magister of Laws from Universidad de los Andes, Managing Partner of BéndiksenLaw.

Listen the podcast here (in Spanish):

Remember, at BendiksenLaw, we are here to counsel you and provide the best legal representation for any labor-related matters you may face. Feel free to contact us!

The Labor Reform in Colombia is shaping up to be a crucial issue that will have a significant impact on the relationship between companies and their employees in the country. In light of this perspective, BéndiksenLaw, a law firm specialized in counsel for national and multinational companies, has conducted an informative webinar where the most relevant aspects of this reform were analyzed, revealing six key elements that will affect labor relations in companies.

1. Higher labor costs: One of the direct consequences of labor reform, according to Sebastián Béndiksen, lawyer and master of law from Universidad de los Andes and managing partner at BéndiksenLaw, will be the increase in labor costs for companies. All labor surcharges and indemnities will be affected, as well as payments associated with apprenticeship contracts. Additionally, the extension of paternity leave will also impact the operational costs of companies. An important change is the modification in the night shift surcharge payment schedule, which will start from 6 p.m. instead of 9 p.m., implying an additional cost in companies’ operations. There will also be limitations on working hours and the total time a worker can work, which will require some companies to hire new personnel to cover vacant shifts.

2. Greater job stability: The labor reform aims to provide greater job stability for workers, which will imply changes in the way companies hire. The general rule will be indefinite-term employment contracts, granting greater stability to employees. However, this will also entail higher costs for employers. Furthermore, stricter restrictions will be imposed on dismissals, including the prohibition of arbitrary or discriminatory dismissals, in which case workers will have the right to request reinstatement.

3. Limitation on outsourcing: Another relevant aspect of labor reform is the limitation on outsourcing and the hiring of temporary services. Once the provision of temporary services, which will have a maximum duration of one year, is completed, it will not be possible to extend the contract or hire with a different temporary services company. Additionally, in case of disputes, there is a possibility that the company hiring the services will be considered the true employer of the temporary workers, despite the outsourcing. This means that companies outsourcing services will have to assume greater responsibility and be prepared to face possible legal disputes questioning their role as employers.

4. Review of internal policies: Implementing the Labor Reform will require all companies to review their current contracts and internal regulations. It will be necessary to adjust dismissal processes and include aspects related to inclusion and labor rights in companies’ internal policies. For example, special attention must be given to the non-discrimination of non-binary individuals and the protection of those who change their gender identity. Additionally, almost any form of inappropriate behavior will be considered workplace violence, and companies will be required to offer flexible schedules in certain cases. These aspects, which are currently not present in most company regulations, must be incorporated to comply with updated labor regulations.

5. Job formalization: The Labor Reform includes a chapter dedicated to the formalization of jobs in various areas, such as digital platforms, agricultural work, employment for migrants, professional athletes, and domestic workers. This measure aims to promote the formalization of different economic sectors and encourage compliance with labor and social security obligations.

6. Strengthening of labor unions: The Labor Reform also aims to strengthen workers’ associations and labor unions, granting them greater facilities for their creation and operation. It is expected to be easier to establish unions and carry out strikes, with fewer opportunities for companies to declare strikes as illegal. Additionally, the consequences for those participating in illegal strikes will be reduced, and their dismissal is prohibited.

Despite the progress represented by the Labor Reform in terms of formalization and worker protection, BéndiksenLaw’s lawyers express concern that the public sector is not included in these modifications. They consider it essential to address abuses in the hiring of services in the public sector. Furthermore, the need to provide support and subsidies to companies during the transition process towards labor formalization, especially for small and medium-sized enterprises that will face a significant burden, is emphasized.

The Labor Reform in Colombia presents significant challenges and opportunities for companies. It is essential for companies to be informed and actively participate in the process of debating the legislation. There are still four pending debates in Congress, so it is crucial to stay attentive, communicate with representatives, and exert social pressure to ensure that the interests and needs of companies are taken into account in this reform. BéndiksenLaw positions itself as a source of specialized advice for companies seeking to adapt to the new legal and labor requirements.

Remember that at BéndiksenLaw, you will find the support and counsel you need to successfully navigate labor changes in Colombia. Do not hesitate to contact us for more information and to protect the interests of your company with this new labor regulation!

Watch the webinar (in Spanish)

To download the presentation (in Spanish) click here

Sebastián Béndiksen, managing partner at the firm BéndiksenLaw Colombia, speaks with the newspaper El Colombiano about the recent labor reform and its influence on occupational dynamics within companies.

Read the news (in Spanish) here.

Contact us for more information, we will be happy to address your concerns.

BéndiksenLaw examines the aspects of the labor reform and points out that the government does not show concrete support measures for companies.

Read the news (in Spanish) here.

Contact us for more information, we will be happy to address your concerns.

In order to provide greater benefits and offer new services to our clients, we are proud to announce that Mr. Julián Molina, former Superintendent of Family Subsidy, joins our team. Throughout his more than 15 years of professional career, Mr. Molina has accumulated extensive experience in different branches of public law as an advisor and manager. We trust that him joining us will allow us to design solid strategies for the representation and protection of the interests and businesses of our clients against government actions, advise them in the processes of obtaining licenses, permits, concessions and other required authorizations from the national and territorial authorities and provide them with comprehensive legal counsel in public procurement processes. Additionally, Mr. Molina will be in charge of monitoring and identifying important policies at the national or local level that may impact our clients’ businesses, providing them with early warning regarding bills and other regulations relevant to their business, as well as impacting and altering these new regulations to protect our clients’ rights and interests. We present his résumé below:

Education

Mr. Molina is a lawyer graduated from Universidad La Gran Colombia (2005), Specialist in Public Procurement from La Sabana University (2010) and Master in Constitutional Law from La Sabana University (2019). Additionally, Mr. Molina completed a doctoral practice course at the University of Salamanca in Spain (2022) and is currently pursuing his Doctorate in Law at the Sergio Arboleda University.

Experience

Mr. Molina began his career as Ad-Honorem Judicial Assistant in the Council of State’s IV Section, in the office of the State Councilor Dr. María Inés Ortiz Barbosa (2005). Later he worked as Advisor-Attornet in the Administrative and Financial Area (2006) and as Attorney in Charge of the Petitions, Claims and Complaints Office (2008) of the Surveillance and Security Fund of Bogotá (FVS). Subsequently, he served as Substantiating Advisor in the Second Section of the Administrative Court 17 (2009), External Contractor Lawyer in the Surveillance and Security Fund of Bogotá (2010), Coordinator of the Legislative Work Unit in Colombia’s Senate (2010), Legal Coordinator in the Presidency of the Senate of Colombia (2016), Advisor to the Office of the Public Ombudsman (2017) and Head of the Office at the Superintendence of Industry and Commerce (2018). Finally, he served as Superintendent in the Superintendence of Family Subsidy from 2020 to 2022.

Practice Areas

Mr. Molina has extensive experience in Public Law, especially in matters of Public Procurement and Constitutional Law. He has coordinated the projection, review and follow-up of draft reform acts of the Colombian constitution, statutory, organic, framework and ordinary laws, has studied the development and effectiveness of public policies and actions of the different national levels and has provided his opinion on the legislative process, the review of administrative and contractual acts, the constitutionality of bills and on disciplinary, labor, constitutional and administrative law issues. Additionally, he has provided legal support in the approval and discussion of laws, as well as in the realization of political control debates and has advised special electoral-type legislative events. He has drafted rulings that resolve actions of nullity, nullity and restoration of rights in administrative labor matters and substantiation of interlocutory orders, as well as administrative sanctioning acts. In terms of Public Procurement, he has planned and structured Terms of Reference, Specifications, selection of bidders through evaluation and qualification of proposals in accordance with Laws 80 of 1993, 1150 of 2008 and their respective Regulatory Decrees.

Finally, in his performance as Superintendent, he exercised functions of inspection, surveillance and control of the family subsidy system, issued administrative acts of competence of the entity, including appeal decisions in sanctioning processes, intervention and injunctions and coordinated the administrative and regulatory modernization of the entity, with a focus on transparency and citizen participation.

Publications

Mr. Molina is the author of the article “Annotated Basic Legislation of the Family Subsidy System”. Superintendence of Family Subsidy and Ibero-American Center for Social Studies and Training of the Ibero-American Social Security Organization – OISS. Editorial Tirant lo Blanch, published in 2022.

Memberships

Founding Member of the International Association of Public Law – ICON-S Colombia Chapter (2018).

In case you require legal counsel, do not hesitate to contact us.

On December 13, 2022, Colombia enacted Law 2277, embodying the most recent tax reform which came into effect on January 1, 2023 with some exceptions. In this article, our new Head of Tax explains several topics of the reform of interest to our clients.

I. Alternative Minimum Tax.

Inspired by the OECD BEPS global anti-base erosion (GloBE) rules Pillar Two recommendations, the tax reform introduces a new 15% alternative minimum tax for corporate taxpayers, including taxpayers operating in free-trade zones (“zonas francas”). This minimum tax does not apply to non-resident foreign entities.

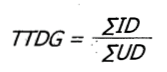

This minimum tax, called Net Tax Rate (Tasa de Tributación Depurada or “TTD” for its acronym in Spanish) is based on the taxpayer’s book profits (with certain adjustments), called Net Book Profit (Utilidad Depurada or “UD” for its acronym in Spanish).

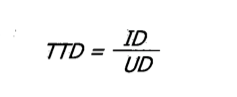

The TTD paid by any given taxpayer, that is, its effective tax rate, is arrived at by dividing the taxpayer’s Net Income Tax (“ID”) by its Net Book Profit (“UD”). It is expressed in the law with the following formula:

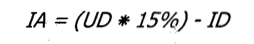

Whenever the TTD computed under the above formula is lower than 15%, taxpayers must determine the amount of Additional Tax Due (“IA”) by multiplying the Net Book Profit (UD) by 15% and subtracting the Net Income Tax (ID):

For purposes of these calculations:

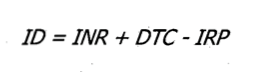

The Net Income Tax (ID) is the actual income tax paid (“INR”), increased by tax discounts or credits originating from tax treaties and by foreign tax credits (“DTC”), minus the income tax paid on passive income from foreign controlled entities (computed by applying the general 35% corporate tax rate to the taxable passive income) (“IRP”). The formula is:

The Net Book Profit (UD), in turn, is calculated under the following formula:

Where:

| UC | is the book profit before taxes. |

| DAPARL | refers to permanent differences set forth in the law that increase taxable income. |

| INCRNGO | refers to income that is neither taxable income nor capital gains income and which affects book profits. |

| VIMPP | is the income determined under the equity method for the corresponding tax year. |

| VNGO | this is the net value of capital gains income affecting book profits. |

| RE | stands for exempt income originating from tax treaties, income received under the Colombian holding regime, exempt income on certain sales of social interest and priority interest housing and income received under certain pension funds |

| C | compensation of prior years’ net operating losses or excess of presumptive income, taken during the tax year and which did not affect the book profit for the tax year. |

Special calculations apply for taxpayers consolidating financial results. In essence:

These alternative minimum tax rules do not apply to the following taxpayers:

II. Capital Gains

The rate for capital gains (“ganancias ocasionales”) generated by Colombian entities and by non-resident entities alike was increased from 10% to 15%.

III. Dividends

Dividends paid to nonresidents are subject to a 2-tier withholding tax calculation, as follows:

IV. Free-Trade Zones

Entities carrying on operations in specified free-trade zones are entitled to a preferential 20% corporate tax rate, except for commercial users, to whom the general 35% tax rate applies.

Effective 2024, the tax reform sets the following distinctions:

Industrial users:

Commercial users:

Commercial free-zone users will continue to be taxed at the general 35% corporate tax rate.

Rules of Exception:

V. Research and Development Investments

The tax credit for investments in qualifying research and development is increased from 25% to 30%.

Cost and expenses qualifying for this tax credit cannot be capitalized or claimed as costs or deductions.

VI. Amnesties

The reform includes the following few amnesties:

Should you have any questions, do not hesitate to contact us.

Seeking to provide a more complete and comprehensive service to our clients, we are proud to announce that our founding partner, Jaime G. Béndiksen, will head the Tax Practice area of our Colombia office. Throughout his more than 50-year professional career, Mr. Béndiksen has accumulated extensive experience in the tax law area, advising a wide variety of clients in Colombia, Mexico and the U.S. which is why we are confident that his appointment will allow us to further strengthen and consolidate our office in Colombia. For this reason, we present his resume below:

Education

Mr. Béndiksen graduated in 1970 from Universidad Nacional Autónoma de México (Mexico City), receiving an LLB, also received a Masters in Comparative Jurisprudence (diploma) from New York University in 1974 and a JD from ICFES in Colombia in 1982.

Jurisdictions

Admitted to practice in Mexico and Colombia (South America).

Practice

Practiced with the law firm of Baker & McKenzie from 1970 through 2011, elected international partner in 1977. With this firm he practiced from 1978 through 1992 in Colombia.

Founding partner of BéndiksenLaw.

Practice Areas

Mr. Béndiksen has over 50 years of experience in Mexican and Colombian tax law in general, with emphasis in tax treaties, competent authority proceedings, international tax planning, supply-chain restructuring, oil exploration, production and services, taxation of software, wealth management, mergers and acquisitions, permanent establishments, cross-border transactions, transfer pricing, employee stock plans and value-added tax. In tax litigation he has secured landmark decisions on complex tax issues, overturning previous tax court positions.

Public Service

Advisor to the Colombian Tax Administration (DIAN) in 2000-2001 to introduce transfer pricing in Colombia, illustrating the DIAN on this area of tax law and its benefits of the system, drafting the first statutory provisions, drafting the bill submitted to Congress and persuading Congress of the benefits to Colombia in approving the system.

Expert Witness

Has acted as an expert witness on Mexican tax law for the US Internal Revenue Service (IRS).

Also acted as expert witness on Mexican tax law in a US arbitration proceeding between two US multinational entities.

Coordinating Counsel for Multinational Clients

Mr. Bendiksen has extensive experience serving as coordinating counsel for multinational clients, first as Head of the Tax Practice Group at Baker & McKenzie Mexico, and, since 2011, at BéndiksenLaw.

Publications

Writes widely on domestic and international tax topics. Among many other publications, Mr. Béndiksen:

Presentations

Frequent speaker at local and international fora, on domestic and international tax matters, including:

Recognitions

Memberships

Languages

Spanish, English, Italian

In case you need legal counsel on tax matters, do not hesitate to contact us.