On December 13, 2022, Colombia enacted Law 2277, embodying the most recent tax reform which came into effect on January 1, 2023 with some exceptions. In this article, our new Head of Tax explains several topics of the reform of interest to our clients.

I. Alternative Minimum Tax.

Inspired by the OECD BEPS global anti-base erosion (GloBE) rules Pillar Two recommendations, the tax reform introduces a new 15% alternative minimum tax for corporate taxpayers, including taxpayers operating in free-trade zones (“zonas francas”). This minimum tax does not apply to non-resident foreign entities.

This minimum tax, called Net Tax Rate (Tasa de Tributación Depurada or “TTD” for its acronym in Spanish) is based on the taxpayer’s book profits (with certain adjustments), called Net Book Profit (Utilidad Depurada or “UD” for its acronym in Spanish).

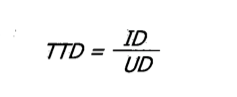

The TTD paid by any given taxpayer, that is, its effective tax rate, is arrived at by dividing the taxpayer’s Net Income Tax (“ID”) by its Net Book Profit (“UD”). It is expressed in the law with the following formula:

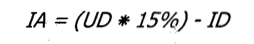

Whenever the TTD computed under the above formula is lower than 15%, taxpayers must determine the amount of Additional Tax Due (“IA”) by multiplying the Net Book Profit (UD) by 15% and subtracting the Net Income Tax (ID):

For purposes of these calculations:

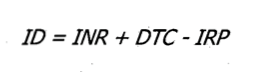

The Net Income Tax (ID) is the actual income tax paid (“INR”), increased by tax discounts or credits originating from tax treaties and by foreign tax credits (“DTC”), minus the income tax paid on passive income from foreign controlled entities (computed by applying the general 35% corporate tax rate to the taxable passive income) (“IRP”). The formula is:

The Net Book Profit (UD), in turn, is calculated under the following formula:

Where:

| UC | is the book profit before taxes. |

| DAPARL | refers to permanent differences set forth in the law that increase taxable income. |

| INCRNGO | refers to income that is neither taxable income nor capital gains income and which affects book profits. |

| VIMPP | is the income determined under the equity method for the corresponding tax year. |

| VNGO | this is the net value of capital gains income affecting book profits. |

| RE | stands for exempt income originating from tax treaties, income received under the Colombian holding regime, exempt income on certain sales of social interest and priority interest housing and income received under certain pension funds |

| C | compensation of prior years’ net operating losses or excess of presumptive income, taken during the tax year and which did not affect the book profit for the tax year. |

Special calculations apply for taxpayers consolidating financial results. In essence:

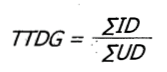

- The Net Tax Rate for the Group (“TTDG”) is calculated by dividing the sum of the Net Income Tax of each Colombian resident taxpayer in the consolidation (“SID”) by the sum of the Net Profit of each such taxpayer (“SUD”):

- Where the result is lower than 15%, the Additional Tax Due for the Group (“IAG”) is determined by the difference between the sum of the Net Book Profit for each Colombian resident taxpayer in the consolidation (SUD) multiplied by 15% less the sum of the Net Tax of each such taxpayer (SID):

- In order to determine the Additional Tax (IA) for each Colombian resident taxpayer, the above result is multiplied by the factor resulting from dividing the Net Book Profit of each taxpayer higher than zero (“UDB”) by the sum of the Net Book Profit of all taxpayers in the group with Net Book Profits higher than zero (“SUDB”):

These alternative minimum tax rules do not apply to the following taxpayers:

- Taxpayers who do not consolidate financial results and their Net Book Profit (“UD”) is zero or lower.

- Taxpayers who consolidate financial results and the sum of all Net Book Profits (“SUD”) is zero or lower.

- Entities incorporated as Special Economic and Social Zones (“Zonas Económicas y Sociales Especiales or “ZESE”).

- Certain government-owned entities engaged in gambling or alcohol and liquor monopolistic activities.

II. Capital Gains

The rate for capital gains (“ganancias ocasionales”) generated by Colombian entities and by non-resident entities alike was increased from 10% to 15%.

III. Dividends

Dividends paid to nonresidents are subject to a 2-tier withholding tax calculation, as follows:

- If the dividends originate from earnings that have not been previously taxed, then they will be taxed at the general 35% corporate tax rate.

- The balance remaining after payment of the above tax is further subject to withholding tax. Here the tax rate was doubled by the tax reform, increasing from 10% to 20%.

IV. Free-Trade Zones

Entities carrying on operations in specified free-trade zones are entitled to a preferential 20% corporate tax rate, except for commercial users, to whom the general 35% tax rate applies.

Effective 2024, the tax reform sets the following distinctions:

Industrial users:

- The ratable portion of taxable income corresponding to exportation of goods and services will be taxed at the preferential 20% rate. This will include health services provided in certain specific free-trade zones to patients residing outside Colombia.

This benefit is subject to the industrial free-zone users signing, with the Ministry of Commerce, Industry and Tourism, in 2023 or 2024, an internationalization and annual sales plan for each tax year, setting forth maximum goals for net income from operations of any kind within Colombia and income from activities other than their authorized activities.

Such a plan will be mandatory for entities securing free-trade zone authorization as from 2025.

Failure to sign the plan or to reach the maximum income goals will result in the benefit of the preferential tax rate being lost and thus being subject to the general 35% rate.

- The ratable portion of all other taxable income will be subject to the general 35% corporate tax rate.

Commercial users:

Commercial free-zone users will continue to be taxed at the general 35% corporate tax rate.

Rules of Exception:

- Industrial free-zone users with an increase of at least 60% in gross revenues in 2022 as compared to 2019 shall be entitled to apply a 20% tax rate through 2025.

- Free-trade zone users who have signed with the Colombian government a so-called “legal stability agreement” (agreements basically freezing the tax provisions in place at the time they are signed and thus protecting against future changes in the tax law) will be subject to the tax rate called for in such agreement.

- The preferential 20% corporate tax rate also applies to the following: offshore free-trade zones; industrial users of special permanent free-trade zones of port services, industrial users of port services in free zones (“zonas francas”), industrial users of special permanent free zones (“zonas francas”), whose main corporate purpose is refining of petroleum-derived fuels or refining of industrial biofuels; industrial users of certain qualifying logistics services and free zone (“zona franca”) operator users.

V. Research and Development Investments

The tax credit for investments in qualifying research and development is increased from 25% to 30%.

Cost and expenses qualifying for this tax credit cannot be capitalized or claimed as costs or deductions.

VI. Amnesties

The reform includes the following few amnesties:

- Late-payment interest: the late payment interest on overdue taxes and customs dues paid on or before June 30, 2023, and on extensions granted by the tax administration on or before that same date is reduced by 50%. Applications for extensions must be filed not later than May 15, 2023.

- VAT returns: VAT returns filed up to November 30, 2022, stating an incorrect tax period and thus null and void, may be filed up to April 30, 2023, with no late-filing penalty and no late-payment interest.

- Taxpayers may, before May 31, 2023, file returns not filed up to December 31, 2022, paying the corresponding amounts due, with a reduction of 60% of the penalty that would apply after the reductions in Article 640 of the Tax Code and a 60% reduction in the interest rate. The same benefits apply where, in lieu of payment, these taxpayers request a payment agreement with the tax administration before May 31, 2023, and sign such agreement before June 30, 2023.

- Taxpayers who have been served notices to file or amend tax returns or to pay taxes assessed, may pay the corresponding amounts on or before June 30, 2023, with a 20% reduction of the amount assessed. The reduction also applies to taxpayers who file for a payment agreement with the tax administration no later than May 15, 2023, and sign the corresponding agreement by June 30, 2023.

Should you have any questions, do not hesitate to contact us.