- December 31, 2023

Colombia – Junk Food Tax – LAW 2227 OF 2022 AND DIAN RULINGS

- by BéndiksenLaw

The 2022 tax reform introduced, with effect from November 1, 2023, a tax classified as healthy, called the tax on industrially ultra-processed edible products and/or with a high content of added sugars, sodium or saturated fats (hereinafter the “ICUI” for its acronym in Spanish).

REASONING IN THE BILL SUBMITTED TO CONGRESS

The ICUI does not pursue collection purposes, strictly speaking.

According to the reasoning in the bill sent to Congress:

“On the other hand, ultra-processed foods, also known as ‘junk food’, have been the cause of chronic non-communicable diseases, such as hypertension, obesity, diabetes and some types of cancer, generating an expense to the health system of approximately 25 trillion pesos per year (2.1% of GDP) (Portfolio, 2022).

“One way to reduce the negative externalities associated with the consumption of sugar-sweetened beverages and ultra-processed foods is to implement a consumption tax on these products. These types of taxes correspond to a Pigouvian measure, and are generally used to reduce the consumption of some goods that result in negative externalities on the health of the population, in order to reduce the expenses of the health system associated with the incidence of diseases derived from the consumption of sugary drinks and ultra-processed foods and improve the well-being of the population.”

As can be seen, the ICUI is planned to correct the negative externality derived from the consumption of junk food on the health of the population through two mechanisms: the disincentive to their consumption and the generation of public resources that contribute to financing the requirements of the health system derived from related diseases.

THE TAX STATUTE PROVISIONS

The ICUI is regulated in articles 513-6 to 513-13 of the Tax Code.

In accordance with these provisions, the main features of the ICUI are as follows:

The Tax Administration

The tax administration of this levy is the Directorate of National Taxes and Customs (“DIAN” for its acronym in Spanish).

Taxable Persons

The producer and/or importer of these products, as the case may be, are responsible for the ICUI.

Taxable Events

Except for exports and certain donations that are excepted, the ICUI taxes:

- The production, sale, removal of inventories or acts involving the transfer of ownership free of charge or for consideration of these products.

- The importation of the aforementioned edible products.

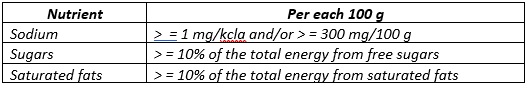

However, it should be noted that this tax is not levied on all such edible products, but only those that have added sugars, salt/sodium and/or fats as ingredients and their content in the nutritional table exceeds the following values:

To calculate the percentages established in the table, the procedure in Paragraph 1 of Article 513-6 of the Tax Code should be followed. Paragraph 1, in addition to establishing the procedure to determinie the values, makes an extremely important clarification, namely, that, in the case of imported goods, the values of sodium, sugar and/or saturated fat content in the nutritional table must be reported in the import declaration. In other words, it will be based on the values contained in line 90 of the import declaration that, at the time of nationalization, determination is to e made as to whether or not the payment of the ICUI is appropriate.

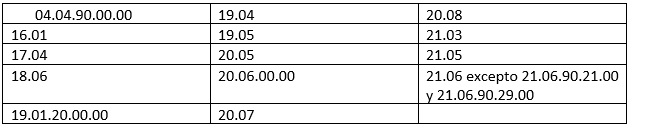

But, as an additional limitation, only goods of the following tariff headings and subheadings are subject to ICUI, to the extent that they contain sodium, sugars or saturated fats in accordance with the definitions referred to below:

Taxable Base

The taxable base of this tax is the sales price.

In the case of donations or removal of inventory, the taxable base is the commercial value.

In the case of imported godos the taxable base on which the ICUI is to be calculated will be the same as that taken into account to settle customs taxes, increased by the value of this tax.

In the case of finished products produced in free zones, the taxable base will be the value of all production costs and expenses in accordance with the integration certificate plus the value of customs taxes. When the importer is the buyer or customer in the national customs territory, the taxable base will be the value of the invoice plus customs. taxes

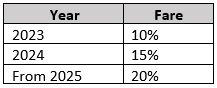

Tax Rate

The tax rate is determined as follows:

Triggering Events

The ICUI is triggered as follows:

Definitions:

Article 513-6 of the Tax Code contains the following definitions:

- Ultra-processed products are industrial formulations made from substances derived from food or synthesized from other organic sources. Some substances used to make ultra-processed products, such as fats, oils, starches and sugar, are derived directly from food. Others are obtained through the further processing of certain food components, such as the hydrogenation of oils (which generates toxic trans fats), the hydrolysis of proteins, and the “purification” of starches. The vast majority of ingredients in most ultra-processed products are additives (binders, cohesives, colours, sweeteners, emulsifiers, thickeners, foamers, stabilisers, sensory ”enhancers” such as flavourings and flavourings, preservatives, flavourings and solvents).

- Ultra-processed products are industrial formulations mainly based on substances extracted or derived from food, as well as additives and cosmetics that give color, flavor or texture to try to imitate food. They are high in added sugars, total fat, saturated fat, and sodium, and low in protein, dietary fiber, minerals, and vitamins, compared to unprocessed or minimally processed products, dishes, and meals.

- Ultra-processed products are understood as having salt/sodium added to them; those to which any salt or additive containing sodium or any ingredient containing added sodium salts has been used as an ingredient or additive during the manufacturing process.

- An ultra-processed product shall be understood as having fats added to it; those to which vegetable or animal fats, partially hydrogenated vegetable oils (vegetable shortening, vegetable cream or margarine) and ingredients containing added greases have been used as ingredients during the manufacturing process.

- Added sugars are monosaccharides and/or disaccharides that are added during food processing or packaged as such, and include those contained in syrups, fruit or vegetable juice concentrates.

- Processed and/or ultra-processed food product that have added sugars will be understood as those to which sugars have been added during the manufacturing process according to the definition of the previous paragraph.

Additional Considerations

- Cancelled, rescinded or terminated transactions of the related to the products subject to the ICUI will result in a lower value of the tax payable, without giving rise to a refund.

- The ICUI constitutes for the buyer a deductible cost in income tax as a higher value of the product, under the terms of article 115 of the Tax Code.

- The ICUI does not generate deductible taxes on sales tax – VAT.

- The ICUI must be itemized in the sales invoice, in addition to the sales tax -/VA itemized on the invoice.

- The taxable period for ICUI will be bimonthly. The bimonthly periods are: January-February, March-April, May-June, July-August, September-October, November-December.

- The deadlines to file the returns and pay the ICUI, other than the ICUI corresponding to imports, will be as follows:

The deadline to pay the taxes corresponding to the November-December 2023 two-month period will be extended from January 10th to the 23rd, 2024, according to the last digit of the TIN.

- In the case of imports, the tax will be assessed and paid together with the settlement and payment of customs taxes, using forms 500, 505 and 690.

- The ICUI return will not be filed in periods in which no transactions subject to these taxes have been carried out.

- The penalty for non-payment of the ICUI is 20% of the value of the tax that has to be paid or 10% of the gross income that appears in the last tax return.

DIAN RULINGS

With respect to this tax, the DIAN has issued various rulings, among which we may highlight the following points:

- The manufacturer of the inputs or ingredients used to manufacture the products subject to the ICUI is not liable for the ICUI, as would be the case – by way of example – of the producer of sugar, fats, oils and starches. The foregoing, unless such inputs or ingredients, individually considered, correspond to ultra-processed sugary beverages (including concentrates, powders and syrups) or to industrially ultra-processed edible products and/or with a high content of added sugars, sodium or saturated fats in the terms defined by the Law.

- The inputs or ingredients used to make industrially ultra-processed edible products and/or with a high content of added sugars, sodium or saturated fats are not taxed with the ICUI, unless such inputs or ingredients, individually considered, correspond to industrially ultra-processed edible products and/or with a high content of added sugars, sodium or saturated fats in the terms defined by law.

- The taxable base of the ICUI on imports consists of the sum of the customs value, customs duties, other duties, taxes or surcharges levied on importation or on the occasion of importation and VAT.

- It is essential that all the legal requirements are met for a product to be considered taxed with the ICUI, one of which is that the product is edible. In this regard, the Dictionary of the Spanish Language contains the following:

(i) “Edible” is that which can be eaten.

(ii) “Eating” means “Chewing and swallowing solid food”.

Therefore, dietary supplements and reconstitution powders that are designed to be ingested in liquid form are not considered edible for the purposes discussed here. Therefore, they do not generate ICUI.

- In relation to sodium, the legislator did not distinguish between added sodium and that which is naturally part of the edible product.

In relation to sugars and fats, only free sugars and saturated fats are taken into account. Therefore, for tax purposes, sugars and fats other than the above that are part of the edible product should not be taken into account.

To illustrate the above: If an edible product in its natural state has 299 milligrams of sodium per 100 grams and 2 milligrams of sodium per 100 grams are added to it, it would exceed the value from which the product is considered taxed with the ICUI (≥ 300 milligrams per 100 grams).

- The definitions contained in Article 513-6 of the Tax Code on processed and/or ultra-processed products that “have added salt/sodium”, “have added fats” and “have added sugars” are not cumulative, although they may concur with each other; therefore, it will be sufficient for one of them to be present for purposes of the ICUI.

- The information related to the ICUI must be included in the XML of the electronic invoice, under Code 35

As of December 1, 2023, discrimination (…) must be carried out under the terms set forth in the technical annex to electronic sales invoice version 1.9

- Finally, although it is not a ruling per se, in a document related to the inflationary effects of the ICUI, the DIAN stated that the products taxed with the ICUI will be those that, as ingredients, have been added sugars, salt/sodium or fats sufficient to carry the front warning label established by the Ministry of Health.

CONCLUSION

The rules of the Tax Statute and the rulings issued by the DIAN, discussed above, leave open a good number of issues.

BéndiksenLaw has the experience and team to assist you with any concerns you may have regarding this lien. Contact us.

Jaime G. Béndiksen