- November 17, 2023

Get ready for December! Obligations and key dates for Transfer Pricing in Colombia

- by BéndiksenLaw

In the complex Colombian business and tax world, Transfer Pricing plays a crucial role. Multinational companies engaging in transactions with each other must comply with this regime to ensure fair taxation. Here, at BéndiksenLaw, we break down the obligations and deadlines you need to keep in mind for the upcoming December 2023.

Transfer Pricing focuses on assigning values to transactions between related companies in different jurisdictions. In Colombia, these obligations apply to companies conducting operations with affiliated entities abroad, in free trade zones, or in low-tax jurisdictions.

Formal obligations: What should you do?

- Informative Return: Companies with assets exceeding 100,000 tax units (UVT) or annual income surpassing 61,000 UVT must file it.

- Local Report: If transactions with economic affiliates exceed 45,000 UVT or involve entities in low or no-tax jurisdictions, filing this report is required.

- Master Report: For taxpayers consolidating financial statements in multinational groups.

- Country-by-Country Report: Applicable to the parent company or corporate office of the multinational group, filing is necessary for those meeting certain conditions.

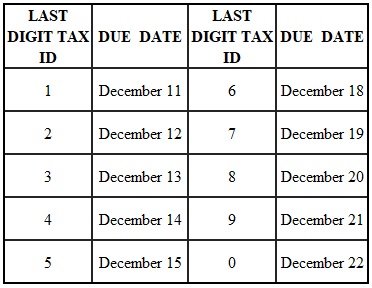

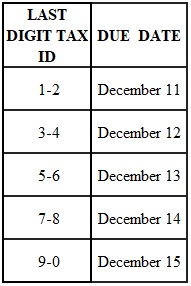

December deadlines: Act in advance

From December 11 to 22, based on the last digit of the Tax ID number (NIT), companies must submit master and country-by-country reports to the tax administration (DIAN), for fiscal year 2022. Ignoring these dates can result in penalties and legal issues.

Claudia González Béndiksen, partner at BéndiksenLaw, emphasizes, “Complying with these obligations is essential to ensure fair taxation and avoid penalties. Companies must stay informed about the requirements to contribute to a transparent and fair business environment in Colombia.”

Master Report – Fiscal Year 2022

Country-by-Country Report – Fiscal Year 2022

Act now! Ensure you meet these deadlines to maintain transparency and fairness in your business transactions.

Need guidance? Contact BéndiksenLaw today.